[PRESS RELEASE – New York, United States, July 18th, 2024] Pawfury (PAW) gains traction as a possible alternative to meme coins, offering real-world solutions, long-term growth potential, and unique features like high staking APY and deflationary tokenomics. Pawfury (PAW)’s Unique Features Emerging as an innovative player, Pawfury (PAW) introducing an innovative technology and robust community […]

Bitcoin’s price has recently recovered from a month of bearish price action. Considering the current upward momentum, the market might even make a new all-time high soon.

Technical Analysis

By TradingRage

The Daily Chart

On the daily chart, the price has found support at the $56K support level. The 200-day moving average, located around the $60K area, has also been reclaimed, along with the $60K level itself.

Yet, the market is struggling to break above the $65K resistance level, as it has failed in the last three days. Meanwhile, with the RSI showing a clear bullish momentum, it could only be a matter of time before BTC trades above the $70K mark again. This scenario would fail if the price drops below $60K again.

The 4-Hour Chart

Looking at the 4-hour timeframe, the market has begun an impulsive rally since breaking the bearish trendline to the upside. Yet, the attempts so far have been unsuccessful in getting past the $65K level, and a correction cannot be ruled out.

Moreover, the Relative Strength Index also shows a clear bearish divergence and overbought signal, which could induce a decline toward the $60K level. Yet, the overall market structure is still bullish in the short term.

On-Chain Analysis

By TradingRage

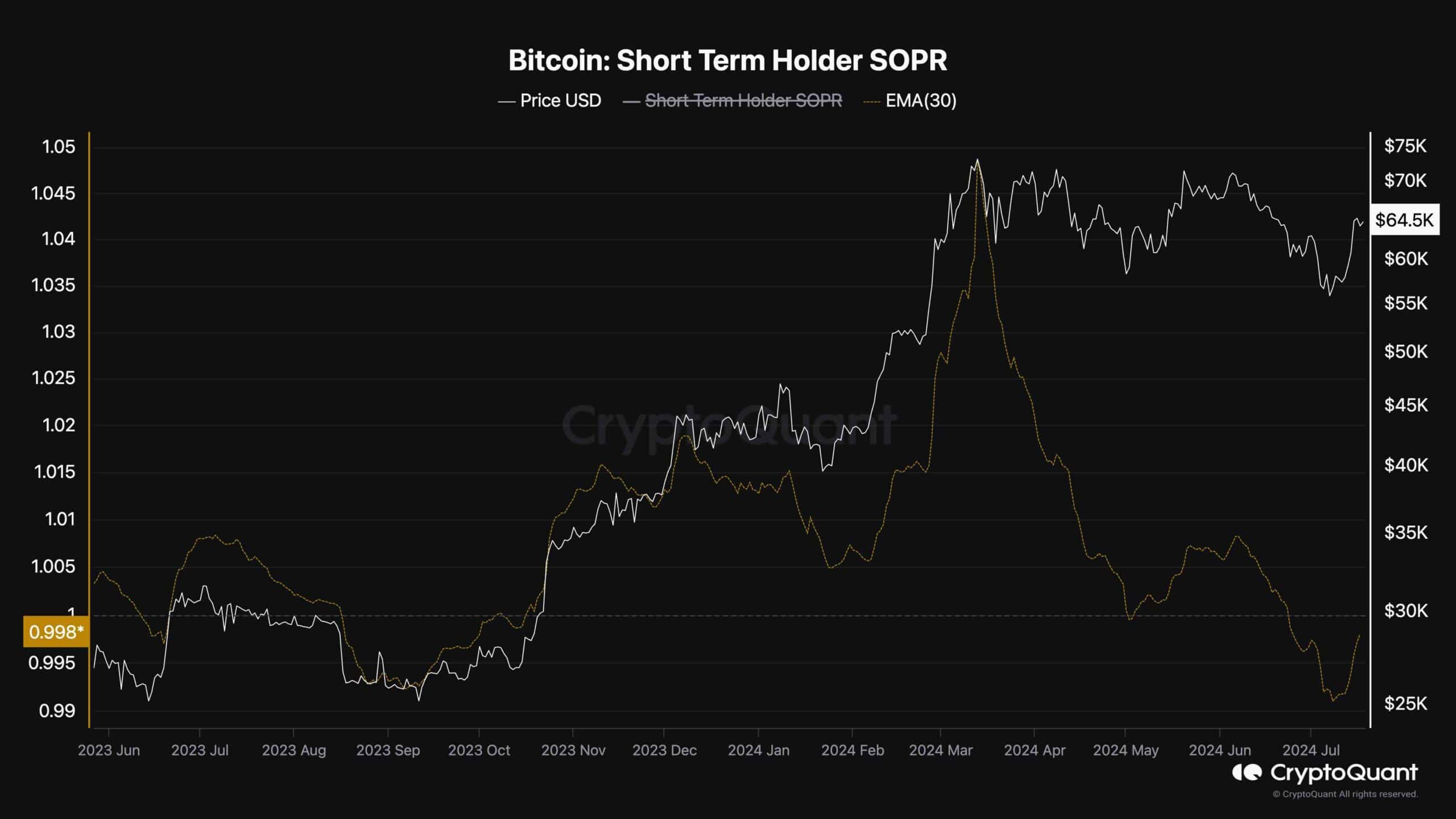

Bitcoin Short-Term Holder SOPR

The buying and selling behavior of short-term BTC holders is one of the key factors that shape the price action in the near term. Therefore, analyzing the Bitcoin Short-Term Holder SOPR metric can be beneficial in predicting price action in the upcoming weeks.

The Short-Term Holder SOPR metric, demonstrated in the chart above, determines whether the holders holding their coins for less than 6 months are realizing profits or losses. Values above 1 indicate selling at a profit, while values below 1 show loss realization.

As the chart displays, the 30-day exponential moving average of the STH SOPR has been below 1 lately, indicating that the short-term holders are selling their coins at a loss. This is a typical signal for correction bottoms during a long-term bull market. So, if the metric recovers above 1, the price will likely rally higher and create a new record high in the coming weeks.

The post Bitcoin Price Analysis: Here’s What it Will Take for BTC to Break Above $65K appeared first on CryptoPotato.